There are really only two good reasons for retailers to invest in programs like traffic and conversion analytics: they help save money or make money. Traffic and conversion analytics can do both.

Across every segment, from specialty luxury to discount merchandisers, retailers are obsessively focused on ways to squeeze more cost out of the system. Given the tight margins in retailing, it’s not hard to understand why. There are plenty of expense lines to prune, and retailers have become very adept at pruning them. Being cost conscious and managing expenses tightly is an important part of what every good retail operator must do.

But what about the top line?

Every retailer lusts after positive comp sales. They separate retail winners from the losers. And while retailers have become very adept at managing expenses, it seems that when the discussion turns to what they need to do to drive comp sales, there’s a whole lot less to talk about. Invariably, the discussion boils down to:

- Getting more buyers into the stores

- Increasing average ticket

The first objective is achieved through advertising and/or promotion to stimulate visitation, and the second is achieved by having store personnel focus on up-selling and cross-selling. This “two-trick pony” mentality to driving comp sales is so well entrenched it’s almost axiomatic. As one stock market analyst summed it up on an earnings call with a major retailer, “Congratulations on the good quarter. Was it ticket or traffic that drove your positive comps?”

There’s a third trick the retail sales pony must learn, and it’s one that most retailers today completely ignore: customer conversion.

Not only is customer conversion another important way to drive comp sales; for some retailers, it may be even more important than average ticket.

The Three Key Sales Drivers

Sales are a function of three variables:

- Prospect traffic

- Conversion rate

- Average sale

So sales performance can be driven by increasing any one individual variable while holding the others constant — or by moving multiple variables in a positive direction.

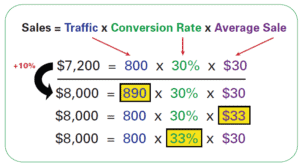

As the example below shows, a 10% lift in sales can be achieved by increasing prospect traffic from 800 to 890 counts, while holding conversion rate and average ticket constant. Alternatively, with 800 prospect counts and a 30% conversion rate, the store can achieve the 10% lift by increasing average ticket from $30 to $33.

Finally, the 10% sales lift could be achieved by selling to more of the 800 prospects visiting the store. If, instead of converting only 30% of the traffic, the store converted 33% of the traffic into buyers, then, even at the same $30 average sale, overall sales would increase by 10%.

Traffic

Driving more prospects into your stores is a good idea. Traffic, is the lifeblood of retailing. But prospects just don’t decide to show up; driving additional prospect traffic to your stores requires some kind of stimulus.

The most common traffic stimulus is advertising and/or promotion. While there’s a vast array of advertising and promotional vehicles retailers can and do employ to drive traffic, they all generally have one common attribute – they cost money. Retailers collectively spend billions on advertising annually in an attempt to drive more buyers into their stores and ultimately increase sales.

It’s important to remember that advertising drives prospects to the store, not buyers. Buyers are part of the prospect traffic group; some of these prospects will become buyers, and the others won’t. This unconverted prospect traffic represents a significant lost sales opportunity.

A campaign may be very effective at driving traffic levels up in the stores, but if at the end of the day, customer conversion rates and/or average ticket values decrease, overall sales may not necessarily increase – or increase enough to justify the investment.

Investing precious budget dollars to drive more prospect traffic to your stores when you may not be adequately serving the prospects you already have doesn’t make sense. Unfortunately, this is exactly what many retailers do, week in and week out, throwing money at advertising and promotions without the faintest clue as to what impact they’re actually having on sales or what the ROI actually is.

How conversion may be driven in response to traffic.

To drive conversion, remember that traffic and customer conversion rate tend to be inversely related. As traffic levels go up, customer conversion often goes down. It’s not hard to understand why this happens. As the store gets busier, it’s harder to find an Associate to help, the check-out lines get longer, and service levels generally decline. Or perhaps the store misplaced (or simply didn’t receive) its shipment of items that were featured in the promotion. Prospects might have come looking for the item — but left when they learned the store didn’t have the item or ran out. Whatever the cause, the net effect is that more people came to the store but left without buying.

As the example above shows, if the advertising successfully drove 10% more prospect traffic to the store (even if the store maintains its $30 average ticket), and if the customer conversion rate decreases from 30% to 28% (not atypical), the overall sales lift would be only 4% instead of the 10% it should be, given the traffic increase.

The moral of the story is this: traffic is good, but your stores need to be prepared for increased prospect volume if you’re going to get the return you’re looking for. If conversion sags, you won’t get everything you should from your advertising investment.

Average Ticket

If there is one variable that retailers universally accept as the sure way to deliver improved comp sales, average ticket is it. Selling more to each buyer. The pursuit of higher average ticket values is worthwhile, and it’s an objective in which retailers invest heavily.

Retailers employ various strategies to drive up average ticket values. They conduct sales training to increase Associates’ effectiveness at up-selling and cross-selling. This is especially important in sales environments where Associate assistance is required – think shoes, jewelry, electronics and apparel.

In retail environments where customers self-help or where less Associate assistance is required, average ticket can be increased through effective plan-o-grams and compelling merchandising programs that make products irresistible to the impulse shopper.

In an attempt to drive up average sale values, many retailers urge their Associates to focus on increasing the number of SKUs or units per transaction (UPTs). The thinking here is that framing the objective in terms of the number of line items on the sales receipt is conceptually easier to internalize than the notion of average ticket or average basket. But regardless of how you communicate it, it amounts to the same thing – sell more to buyers.

Every retailer should try to maximize average ticket values, and practically every retailer striving to improve results is already working hard in this area. Even the most junior Associate is keenly aware of the virtue of driving average sale.

Anything that store-level personnel can influence is, by definition, important. But as important as driving average sale is, I question whether it deserves the time and attention it gets, both as a focus for store Associates and in proportion to its ability to deliver overall sales results.

As heretical as it sounds, is it possible that retailers are too focused on driving average ticket?

Conversion Rate

The third way to drive sales is to sell to more of the prospects that come into your store. I know this may seem like an obvious point, but unless you are measuring prospect traffic and calculating customer conversion rate, you don’t have a clue as to whether or not your stores are doing a good job of converting the traffic that’s already in your stores.

Customer conversion is truly a powerful and unique metric. Unlike any other retail performance metric, it measures how a store performs versus its sales opportunity. Think about it. Prospect traffic defines the opportunity size, and customer conversion measures sales performance versus the traffic opportunity – every hour of every day. No other metric can do this.

Yet many retail executives simply ignore customer conversion, in part because they can’t measure it. They don’t count prospect traffic and therefore have no way of calculating their conversion rate. These retailers simply and erroneously assume that all the prospects that visited the store and intended to buy….did buy.

This is a false and costly assumption.

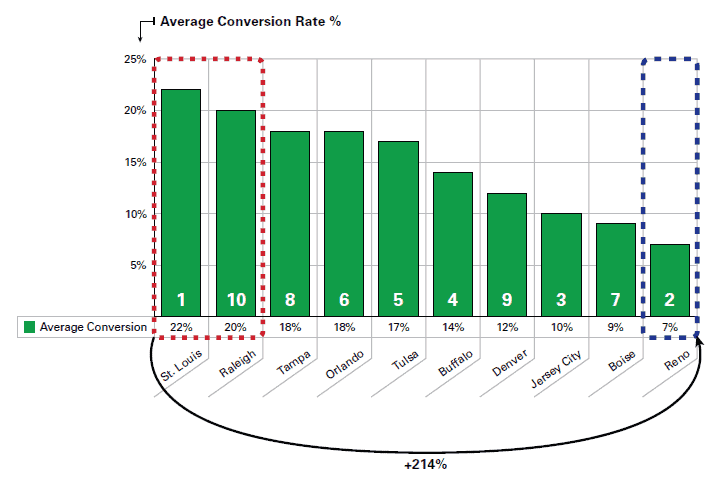

Many didn’t buy, and for various reasons. And unlike average ticket values, which tend to be more consistent across stores, customer conversion rates can vary significantly across stores.

The chart shows the customer conversion rates by store for the same nine-store district. In this group of stores, the variation from highest average ticket to lowest was 30%. For these same stores, conversion rate variance from highest to lowest was over 200%.